Deciding how to save or invest for a child’s financial future is a dilemma for many parents.

There are a number of ways to do it, including saving or investing up to £9,000 each tax year through a Junior Isa or by using a slice of your own £20,000 tax free Isa allowance.

However, one lesser known route is being offered by the Royal Mint, the home of UK coinage and the primary producer of gold, silver and platinum bullion bars.

It launched its Little Treasures, an online precious metals account at the end of 2020 and interest appears to be growing.

Isas and Jisas are a popular way of saving and investing for a child’s future used by many individuals.

Compared to January 2021, the first full month of Little Treasures being sold, there was an increase of 202 per cent this January.

It offers parents an alternative to typical savings and investments, particularly given soaring inflation, economic uncertainty and stock market volatility at present.

The account enables you to purchase gold in a digital format, called DigiGold, allowing you to own a fractional amount of gold held within the Royal Mint’s vault.

This can be added to as and when you please and eventually gifted to a child or grandchild when you decide they are ready to receive it.

The person who opens the account has full legal ownership of the holdings within it and it is entirely up to them if and when they gift the proceeds.

Over the last 5 years, The Royal Mint has seen the number of ounces of DigiGold Gold sold increase by 242 per cent.

If they want to gift, they can choose to either sell their gold back to the Royal Mint for cash, redeem the digital gold for physical gold coins or bars, or transfer the holdings to the intended account – as long as the recipient is over 18.

It requires a minimum investment of £25 to open an account and The Royal Mint allows you to review and manage your account online. There is no maximum limit on what can be deposited into the account.

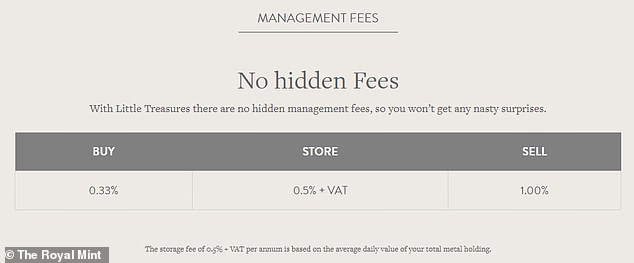

However, there are fees to be aware of. This includes a 0.33 per cent charge when you purchase, a 1 per cent fee when you sell as well as a 0.5 per cent + VAT fee for its vault storage.

This means a £1,000 deposit would cost you £3.30 when you invest in the precious metals account.

If all things remain the same, it will cost you a further £6 in annual maintenance costs and when you decide to cash in the equivalent of £1,000 it will cost you £10 to do so.

It’s worth noting that the annual management cost will be based on the average daily market value of your total gold holding stored in the vault.

It’s also worth noting that unlike with most banks and building societies, your money won’t be FSCS protected up to £85,000 per individual in the event that the Royal Mint were to fail.

When you wish to sell, The Royal Mint will offer to buy your Digital Gold back at the live metal spot price minus a 1 per cent fee.

However, when you buy its ‘DigiGold’ via Little Treasures you own it and have legal title to it, with the Royal Mint acting as custodian.

This means in the event of a bankruptcy or nationalsation of The Royal Mint there is no risk of financial loss. The Royal Mint’s vaulted gold is also all fully insured.

Rachel Springall, finance expert at Moneyfacts says: ‘Savers may be looking at alternatives to a more traditional cash investment, particularly when it comes to saving for their children and they have many years ahead to grow a pot for their future.

‘As an institution, The Royal Mint is a well-known and trusted brand, so they could well entice investors looking for alternative ways to invest their cash.’

What are the tax implications of Little Treasures?

Gold bullion coins have the advantage of being exempt from capital gains tax. However, DigiGold does incur capital gains tax.

Capital gains tax can be charged on any profit you make on an asset that has increased in value, when you come to sell.

Each individual has a capital gains tax allowance of £12,300 each tax year meaning that any capital gains made up to that amount are tax free.

Gold bullion coins have the advantage of being exempt from capital gains tax.

If you end making a gain beyond £12,300, however, it is worth bearing in mind that any gains made via your Little Treasures account will incur be charged at 10 per cent if you’re a basic rate taxpayer and 20 per cent if you’re a higher rate taxpayer.

Obviously this means the tax position is less advantageous than it would be using a Junior Isa or your personal Isa allowance to save or invest for your child.

When saving in a cash Jisa, all interest earned will be shielded from tax, while those who invest in a stocks and shares Jisa will be shielding any dividends or capital gains from the taxman.

How does gold stack up against savings?

If you’d invested £25 a month in gold over 18 years between 2002 and 2020, you would have ended up with £13,393, according to the Royal Mint’s analysis.

Compare that with putting the same amount into a 2 per cent cash Isa – you would have £6,493.

Gold is often described as the ultimate ‘safe haven’ asset because it holds its value when other asset classes fall.

However, it’s important to remember that gold is a commodity and its price is influenced by supply and demand and although gold has performed well in the past there is no guarantee of this continuing to be the case in the future.

If you’d invested £25 a month in gold over 18 years between 2002 and 2020, you would have ended up with £13,393. Compare that with putting the same amount into a 2 per cent cash Isa – you would have just £6,493. Or simply setting it aside with no interest at all – £5,400

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown says: ‘It’s misleading to compare past performance to savings accounts, given that one is an investment and the other offers a guarantee of capital plus interest.

‘It may be something you consider as part of a diversified portfolio, if you just invest in gold, you are completely exposed to the gold price when the environment changes, and as with all commodities it’s dependent on sentiment, speculation, supply and demand.

‘Investing in gold involves risk to your capital, and there is no income, so it isn’t going to be right for someone looking for the security of savings.’

During times of economic uncertainty the gold price tends to do well.

In summer 2020 following the outbreak of Covid-19, the price reached an all time high of $2,067 per ounce (£1,574).

Since the Russian invasion, gold has surged once again. On the day Russia launched its invasion of Ukraine, gold hit $1,970 per ounce (£1,466) and yesterday the price even hit $2,000 per ounce (£1,527).

Yet in between the outbreak of the pandemic and the invasion of Ukraine, the price of gold fell.

In March 2021, gold dropped to as low as $1,684 per ounce (£1,220 which demonstrates that many of those who opted for gold in 2020 would have seen their initial investment fall in value.

Unlike with savings, your capital is therefore at risk and yet with inflation reaching 5.4 per cent as of January, many savers may feel that some risk must be taken to avoid the value of their child’s nest egg being eroded away over time.

Standard savings rates are all woefully failing to keep up with inflation. The best paying easy access deals pays 0.8 per cent whilst the best one year fixed rate deal pays 1.5 per cent.

For those considering a Junior cash Isa for their children, rates are a little more appealing.

Bath Building Society pays 2.65 per cent, Family Building Society pays 2.4 per cent whilst Coventry Building Society pays 2.35 per cent.

How does gold stack up against the stock market?

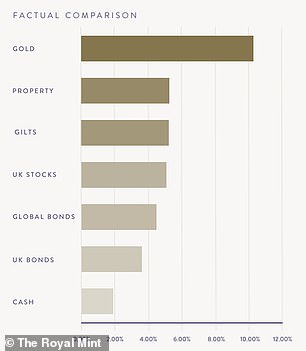

If you had purchased gold exactly 20 years ago at £204 per ounce you would now be sitting on a gain of more than 600 per cent.

That’s an average annual return of more than 10 per cent. Even compared to property prices that looks meaty.

Average property prices have risen from £98,000 to £275,000 over the past 20 years according to Land Registry Data. This represents average annual growth of about 5.3 per cent over that period.

Investing in the stock market will likely have made for similar returns to this.

Considering the performance of the average global fund sector, the MSCI World index returned 371 per cent over the past 20 years whilst the average fund in the IA global sector returned 307 per cent over the same period according to figures crunched by interactive investor – albeit ignoring platform charges, management charges and dividend payments.

However, that’s not to say better returns are not possible when investing in stocks and shares.

For example, someone who invested in Scottish Mortgage Investment Trust exactly 10 years ago would have seen a return of roughly 600 per cent ignoring platform charges, management charges and dividend payments.

Furthermore, the headline growth only tells half the story.

Gold does not produce an income unlike residential properties that can receive rent whilst owning shares in companies are often rewarded via dividends.

Myron Jobson, a personal finance campaigner at Interactive Investor says: ‘All investments come with a degree of risk, but gold is particularly tricky to value because it does not produce anything or generate income.

‘However, gold is viewed as a hedge against inflation and a store of value through thick and through thin.

‘This is because governments and central banks cannot simply print more gold, as they can currencies. As a result, its value is preserved.

‘But gold can be flighty too, and can be influenced by anything including the strength of the US dollar and more.

‘Not “putting your eggs in one basket” is key – regardless of your investment approach.

‘Diversification is the name of the game when it comes to investments, reducing potential risks and increasing potential returns by spreading your investments across different assets.’

The account charges associated with Little Treasures are also higher than most DIY investing platforms.

Hargreaves Lansdown, for example charges a 0.45 per cent annual charge on balances up to £250,000 and a additional £11.95 charge when you deal in shares, investment trusts, ETFs and bonds. Funds attract no charge.

At the other end of the spectrum, a platform like Vanguard allows investors access to its range of funds for an annual management fee of just 0.15 per cent.

‘The fees associated with the Little Treasures account are a sticking point,’ says Jobson, ‘the account operates a percentage fee structure – meaning costs will escalate the more you put in and on investment growth.

‘The levying of a 1 per cent to sell a holding is particularly difficult to stomach.

‘Investing in a low-cost global index tracker fund and no set up or exit fees may prove a better investment, giving access to a wider range of liquid assets.’

Little Treasures verdict?

Little Treasures should be seen as one option for parents and grandparents looking to build a nest egg. However, it should not be deemed the only option.

It is not a substitute for an Isa or Jisa which offers tax free savings and investments.

‘You need to understand the difference between the risks involved in this product compared to a cash Jisa or child savings account – which is essentially the difference between saving and investing,’ says Coles.

‘You also need to appreciate that you can’t build a diversified portfolio with this product in the same way you can in a stocks and shares Jisa.

‘This may appeal to people who are worried about market volatility, want to invest for children, and feel gold is a sensible option in difficult times.’

‘You’re also putting money in, in the hope that gold grows in value. There’s no income available along the way like the dividends from stocks and shares.’

The key difference with a Jisa is that it belongs to the child and once they turn 18, it becomes their money to do what they like with, whilst with a Little Treasures account, it belongs to whoever sets up the account until it is gifted.

This means that your inheritance tax position may be prejudiced by opting for a Little Treasures account over a Jisa.

Inheritance tax is a tax on the estate of someone who has died, including their property, possessions and money.

It is usually charged at 40 per cent on anything above the nil-rate band allowance.

The standard nil-rate band is £325,000 per individual or £650,000 when combined with a spouse or civil partner.

‘The Royal Mint says you are able to give the gold to the child whenever you want to,’ says Coles.

‘This would indicate it doesn’t have the same tax benefits of a Jisa, which allow you to count the money as having been given away when you pay into it.

‘So the clock starts ticking for inheritance tax purposes and after seven years it’s considered to be out of your estate for inheritance tax purposes.’

However, for all its positives, parents need to be aware before saving or investing in a Jisa, that once the child turns 18, it becomes their money to do what they like with.

The footballer George Best once said: ‘I spent a lot of money on booze, birds and fast cars. The rest I just squandered.’ Many parents fear their children might follow in his footsteps once they receive the funds in their Jisa at 18

While you might hope all your hard-earned savings might go towards something sensible such as a deposit for a property or on tuition fees, you ultimately won’t have the final say on how the money is spent.

For anyone fearful of what their 18-year-old son or daughter might do with a sudden cash windfall, using their personal Isa allowance could be an alternative option. But Equally investing in gold could also be.

However, that does not necessarily need to be done via the Royal Mint or any other website that enables you to buy physical gold.

Jobson says: ‘Gold can be a good portfolio diversifier and one of the easiest and cheapest ways to invest in the asset is through an exchange traded commodity that tracks the price of gold.

‘We like the iShares Physical Gold ETC. Unlike many commodity funds, this one buys gold bullion instead of gaining exposure to the metal by buying derivatives.

Derivatives are financial contracts that are derived from the asset but have no direct value in and of themselves.

With low ongoing charges of 0.14 per cent, it is an easy, flexible and cheap way to invest in the asset.’