Households are being urged to check now if they are one of the 862,027 due a refund of overpaid council tax. An investigation by the UK’s biggest consumer website, MoneySavingExpert.com (MSE), reveals those in England, Scotland and Wales could claim a total of £150.2 million back – worth an average £174.

There are a number of reasons why households may be able to get cash refunds from their council but the key one is where the householder has moved out of the area, but they had already paid the bill upfront. In most cases council tax is paid in advance (including for those who pay monthly) and, if someone fails to close their account or doesn’t pay by direct debit, the council may struggle to refund automatically if they’ve moved. This means the account will likely be closed in credit.

MSE is today prompting consumers that the easiest way to avoid being due overpaid council tax is to set up a direct debit with their local authority, so they can automatically process any refunds. Those who think they might be able to claim cash back can call, email or live chat their council – each council will have its own process for reclaiming.

£150.2 million due to council taxpayers across Great Britain

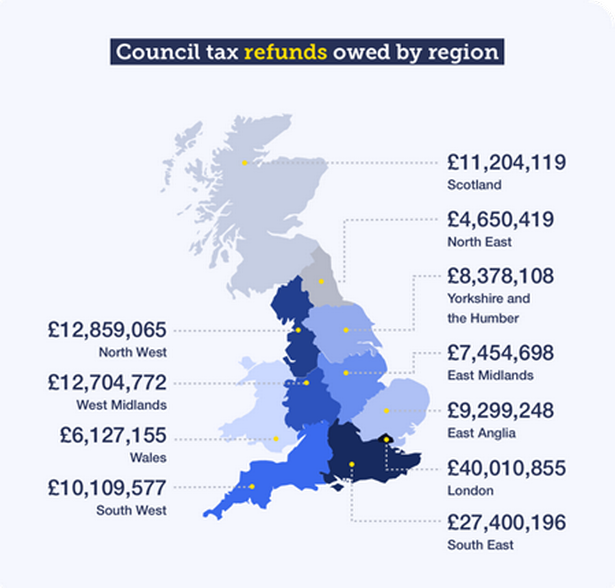

MSE submitted Freedom of Information (FOI) requests to all 364 local authorities in England, Scotland and Wales. This map shows a region-by-region breakdown of council tax overpayments waiting to be claimed by residents.

(Image: Moneysavingexpert.com)

Thirty eight councils each holding more than £1 million in refunds

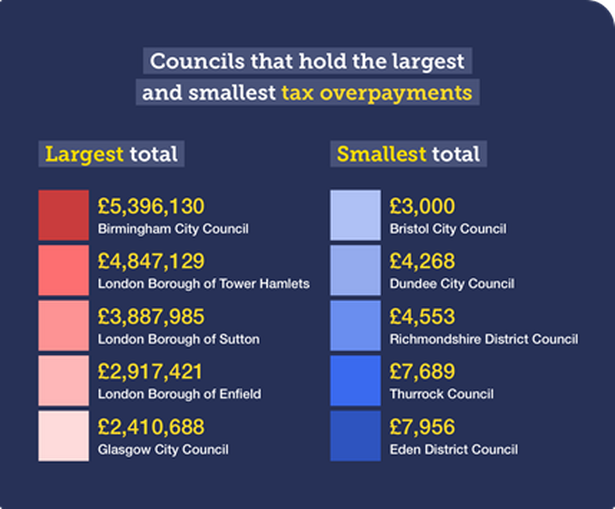

Thirty four councils in England, three in Scotland and one in Wales each hold council tax overpayments worth over £1 million, MSE’s FOI revealed, with Birmingham City Council holding the most: almost £5.4 million.

Gareth Shaw, deputy editor at MoneySavingExpert.com, said: “While many councils do make an effort to track down those who have cash lying unclaimed, they are still staggeringly sitting on £150 million worth of overpayments. You’re less likely to have overpaid if you use direct debit, but it’s not impossible, so if you’ve moved home, it’s worth checking if you might be due – especially if you changed local authority area and paid by cash, cheque or standing order instead. Each council has its own way of processing claims, but some have an easy online form.

“But don’t just call on the off chance you might be due – do a little bit of digging so you don’t clog up councils’ switchboards for those who need essential and urgent support. Check your previous statements and bills to see if council tax you paid upfront covers a period after you moved and if you closed your account in credit.”

(Image: moneysavingexpert.com)

How to check and claim back council tax

Setting up a direct debit is one of the easiest ways households can help reduce their likelihood of overpaying on council tax. Paying this way also makes it easier to reclaim refunds if they are due.

This is because councils will have the bank account details on their systems – making it easier to automatically process refunds for overpayments. But households are reminded to cancel a council direct debit and close the account if they are moving to an area covered by a different local authority.

The best way for households to check if they’re due cash – and then reclaim it if so – will depend on their council. Local councils’ contact details can be found on Gov.uk. Some councils may offer a simple online council tax refund form to complete – though those doing this will be asked to provide eligibility evidence for any backdated claims.

For other ways to save, including available council tax discounts and how to lower your tax band – visit MSE’s guides on Council Tax and Government Grants.

For more stories from where you live, visit InYourArea