Below we round-up the key features of Chase’s new account and how it compares. The new account, which doesn’t come with a monthly fee, is currently only available on an invite-only basis. If you’ve not had an invite, you can sign up to the waiting list on Chase’s website where you should get an invite to open the account ahead of its expected wider launch in early November.

If you don’t want to wait til then, our Best bank accounts guide has a detailed breakdown of the current top accounts for cashback, overdrafts and more, plus various cash incentives of up to £130 available for switching.

Chase’s key features include 1% cashback for a year and 5% interest

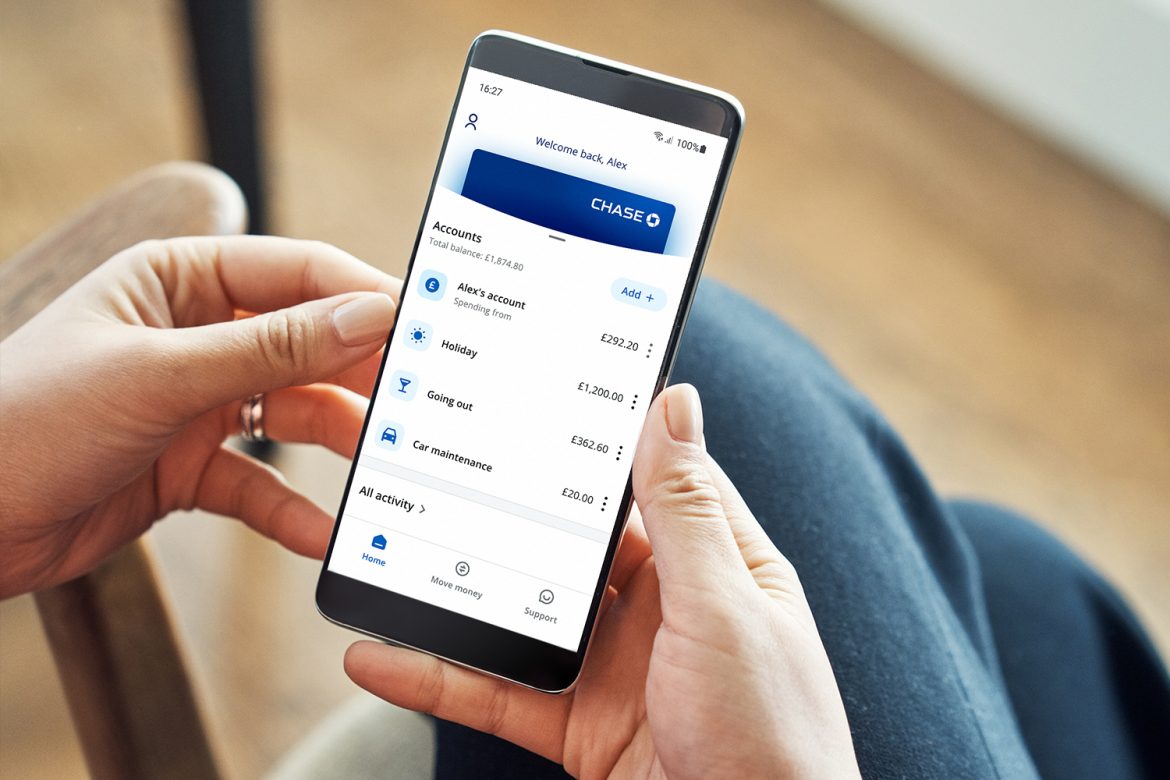

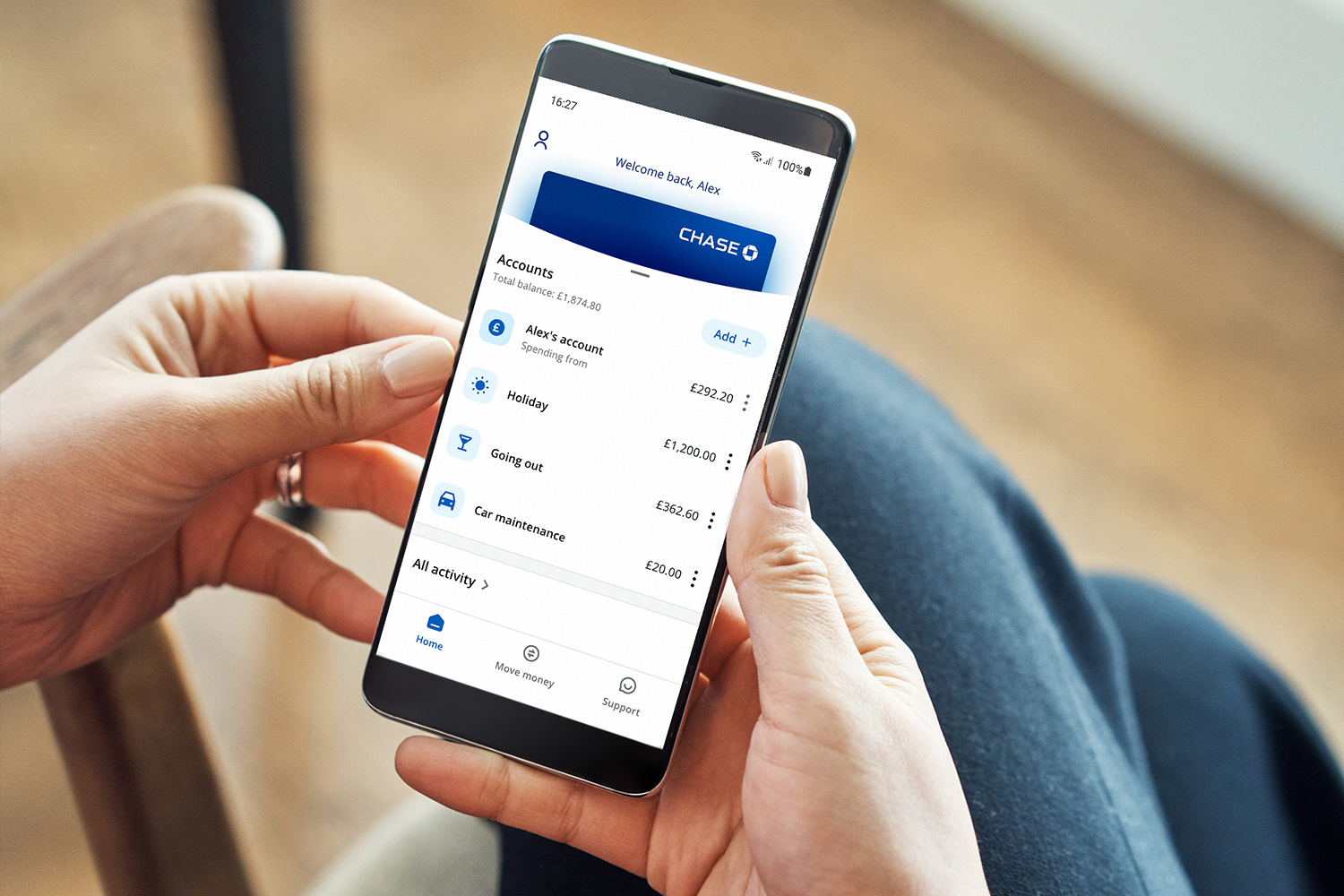

Chase’s current account is app-only, which means you’ll need a smartphone to open and operate it. In addition, while you can make purchases on your debit card (it won’t have a card number printed on it for privacy reasons but you can view this at any point in the Chase app) you can’t yet set up direct debits, though JP Morgan plans to enable this by the end of the year.

Cash held in both Chase’s current account and the linked savings account is protected by the Financial Services Compensation Scheme (FSCS) up to a total of £85,000. Here’s a round-up of Chase’s key features:

- It pays 1% cashback on most purchases for 12 months. You can transfer cashback from the ‘Rewards’ section of the Chase app to your main account balance whenever you like. The 12 months starts from the date you activate cashback in the app, so make sure you do this to start earning. Certain purchases aren’t eligible for cashback, such as gambling, but you can see a full list of exclusions on the Chase website.

- It pays 5% AER variable interest on ’rounded-up’ savings. If you opt in for this perk, Chase will automatically round up every purchase you make up to the nearest pound and save the difference. For example, if you spend £9.55 at a supermarket, Chase will round this up to £10, and save 45p in a separate account. It’ll pay 5% AER variable interest on these amounts. This beats the current Top savings rates, though it’s only on amounts you’ve saved through the round-up feature, which means you can’t top it up with extra cash.

Interest is calculated daily and paid monthly into the savings account, and after a year the entire balance is transferred over to your main balance, though you can withdraw funds penalty-free before this. There’s no time limit on this feature, so you can keep saving after the first year – though as the rate is variable, the amount of interest you get could change in future.

- It offers fee-free debit card use abroad. You won’t be charged any fees for making purchases or cash withdrawals outside the UK. While this isn’t unique for a challenger bank – competitors, such as Monzo and Starling, offer this too – it’s a nice feature to have if you’re planning to travel overseas. For more on the best debit cards to use on holiday, check out our Travel cards guide.

- It gives you the ability to split your current account cash into different ‘jars’. These jars have their own separate current account number, and you can use your debit card to spend from the account of your choice by selecting which account to use via the app when you make payments. The idea is to help people with budgeting and saving.

Chase doesn’t currently have an overdraft facility, but it’s told us it’s looking to offer lending products later on.

How Chase compares

Chase’s cashback and round-up savings features are nifty, but you need to do your research and check if it’s the best account for you based on your needs. Crucially, Chase’s current account doesn’t come with any switching incentives, so if you’re after cold, hard cash there may be better alternatives out there. For example:

- You can nab £130 switching an existing current account to Santander. Santander currently pays both new and existing customers £130 to switch to its 123 Lite account, which offers 1% to 3% cashback on household bills. While the account charges a £2/mth fee, the switching cash negates this, and those with mid-to-large bills can make around £40 to £80/yr after the fee. Of course, there’s no reason why you couldn’t switch to Santander but also open a Chase account and use Santander Lite to pay for any bills that qualify for cashback and Chase for all other purchases in order to maximise cashback.

- You can get £100 switching to Nationwide – and some can get a 0% overdraft too. Nationwide offers switchers to a range of its accounts £100 – the standout is the fee-free Nationwide FlexDirect, which offers a year’s 0% overdraft up to £2,750 depending on your creditworthiness. Plus, you can earn 2% interest on up to £1,500 in the first year.

- Other switching offers include £110 cash and a £30 Uber Eats voucher. For full information, see our Best bank accounts guide.

When it comes to cashback, Chase’s account is a solid pick though. An alternative option includes:

- American Express’ Platinum Cashback Everyday credit card, which pays a higher 5% cashback but only on purchases for the first three months up to a maximum of £100 worth of cashback. You’ll also need to spend at least £3,000 in a year to earn any cashback, and after the first three months the rate drops to 0.5% unless you spend over £10,000 in a year – only then does it match the 1% Chase pays. Amex cards also aren’t accepted everywhere, and if you’ve had one in the past two years you won’t be eligible for the 5% introductory bonus.

If you’re planning a big purchase and you know you’ll hit the £3,000 trigger, Amex might be your best option – though it could be worth using Chase after the first three months as unless you’ll spend £10,000/yr you’ll earn a higher rate of cashback, even if it’s only for a year. For more credit card rewards, including £264 in bonus Nectar points and a £30 Amazon voucher, see our full Credit card rewards guide.