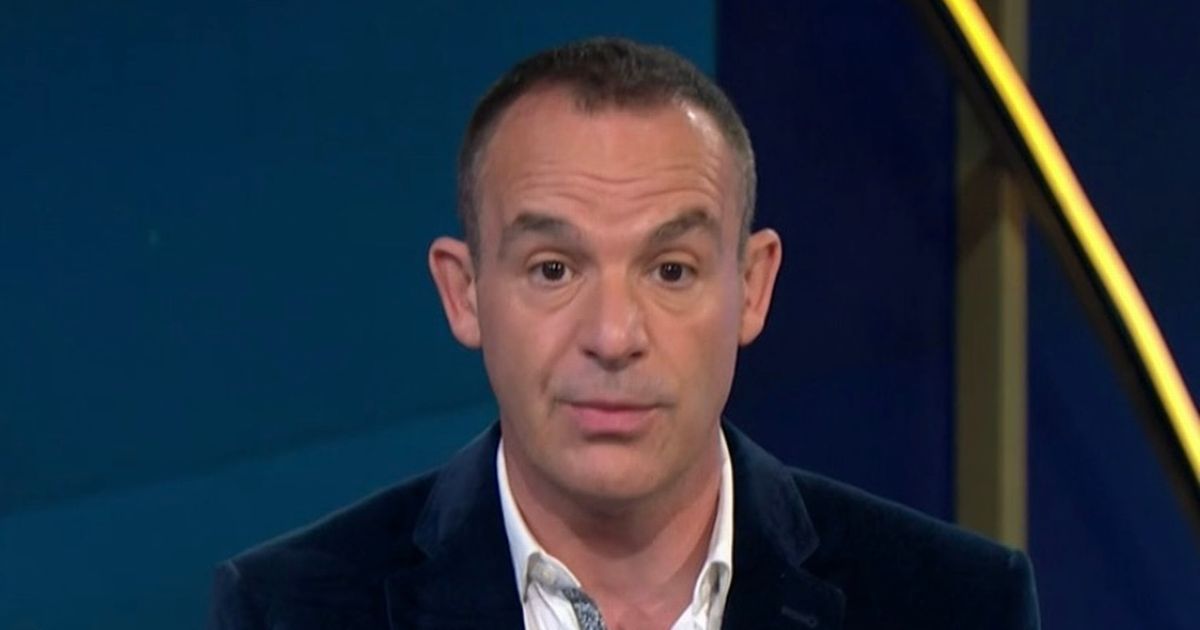

Money Saving Expert Martin Lewis has advised Brits to close down their Cash ISA savings accounts as there’s “virtually no point in having one”. In the past, Martin encouraged people to open up ISA savings accounts, but now he’s changed his advice.

A cash ISA is a type of savings account that lets you earn interest on your savings without paying tax on it. Those with them can save up to £20k per person per tax year.

But you can only open one cash ISA account per year. While Martin Lewis initially urged savers to open one, he’s now shared why his stance has changed and why people should now ditch the account, MEN reports.

Writing on his MoneySavingExpert website, he explains that even with the current standout top easy-access 1.5 per cent from app only bank Chase, you’d need nearly £70k to generate £1k of interest. This is due to everything changing with the Personal Savings Allowance launching back in 2016.

A PSA means basic 20 per cent rate taxpayers can earn up to £1,000 interest a year from any and all savings without paying any tax on it; after that their interest is taxed at 20 per cent. As Martin explains, higher 40 per cent rate taxpayers can earn up to £500 a year; after that their interest is taxed at 40 per cent. Top 45 per cent taxpayers don’t get a PSA – all their interest is taxed at 45 per cent.

To benefit from the cash ISA, you’d need to earn above that thresholds to feel the benefit. Those with savings or earnings big enough to break the limit can protect more interest from tax.

“Be brave, ditch the cash ISA and earn more.” Offering even more advice, Martin has also shared advice on different types of ISAs like the Lifetime one.

Find out how you can get more news from HertsLive straight to your inbox for free HERE.