NS&I has unveiled a new issue of its Green Savings Bonds, doubling the rate of interest it first offered at launch just four months ago. How good is it and why do savers need to watch out for tax?

The government’s savings arm – NS&I – has launched a new issue of Green Savings Bonds, paying 1.30% gross/AER fixed for three years.

This is double the rate offered at launch in October 2021, where the much-anticipated Green Savings Bonds was dubbed a ‘disappointment’ by savers and finance experts.

As part of the second issue of the bond, accounts can be opened online (16+ savers) with a minimum investment of £100 and maximum of £100,000. NS&I offers a 30-day cooling-off period and interest is earned daily and added once a year on the investment’s anniversary, and paid on maturity.

If you already opened the first issue of the Green Savings Bond, you won’t get the higher rate. But NS&I confirms savers can open the second issue of the bond.

Money invested in them will help finance green projects selected by the government, including to tackle climate change as well as make the UK “greener and more sustainable”.

Ian Ackerley, NS&I chief executive, said: “We are pleased to offer savers the opportunity to invest in a second Issue of Green Savings Bonds at a higher interest rate.

“Since we launched Green Savings Bonds in October 2021, average rates among fixed term products have increased, along with the bank base rate. This new Issue means that savers can save at a new competitive rate whilst also supporting the UK’s green agenda in six key areas to help make our environment greener, cleaner and more sustainable. Our savers also benefit from NS&I’s 100% security on all capital invested due to HM Treasury’s backing.”

How good is the Green Savings Bond interest rate?

While the rate between the first issue at launch four months ago and the second issue now has doubled, there are other providers offering better deals.

The current top three-year fix is offered by Al Rayan Bank, paying an expected profit rate of 1.86% gross/AER, followed by 1.85% gross/AER by Tandem, QIB (UK), Secure Trust Bank, UBL (UK) and Bank of Ceylon (UK), Moneyfacts data revealed.

In fact, there are 10 providers offering an interest rate of 1.75% and above in this product category, easily outstripping the offering from NS&I.

And savers can beat the NS&I rate by only locking their money away for a year, rather than three.

Tandem Bank offers 1.45% on a one-year bond with a minimum £1 investment, according to Moneyfacts. Al Rayan also pays an expected profit rate of 1.45%.

Rachel Springall, finance expert at Moneyfacts, said: “The initiative to support green projects is a welcome one and there was a lot of buzz surrounding the Green Bond from NS&I before its launch in October 2021. However, paying a rate of 0.65% fixed for three years, at the time it may well have been underwhelming for savers as they could have found a much higher rate elsewhere

“Some savers may not be too keen to lock their money away for two or three years, but there are plenty of fixed bonds for 12 to 18 months that pay over 1.40%, there are even some notice accounts too paying over 1%. Savers could also consider putting their cash in a savings account with a building society, which support local causes.

“NS&I is a trusted brand and there will be savers attracted to them as a safe haven for their cash. In the past NS&I offered ‘pensioner bonds’ and as these offered a very attractive rate, there was a stampede of savers looking to take advantage.”

Watch out for savings tax

While savings rates have been at historic lows, as they’re starting to rise, savers need to be aware of the Personal Savings Allowance, particularly with the NS&I Green Savings Bonds which pays all interest at maturity.

The Personal Savings Allowance offers basic rate taxpayers the ability to earn up to £1,000 savings income (£500 for higher rate taxpayers), free from tax. Additional rate taxpayers aren’t eligible for the tax break. Anything above is taxed at your marginal rate.

Anna Bowes, co-founder of Savings Champion, warned: “One thing to watch out for is that the interest you earn on Green Savings Bonds will count towards your taxable income in the tax year your Bond matures.

“This means that rather than spreading the interest out over the term, it will all count towards your Personal Savings Allowance in the year of maturity only, as is the case with the NS&I Guaranteed Growth Bonds.”

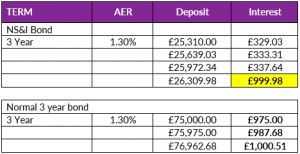

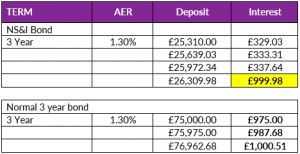

The below table from Savings Champion reveals the subtle difference in how interest is paid (annually vs at maturity) in relation to the PSA:

This essentially means that basic rate taxpayers can save around £25,000 in the NS&I Green Savings Bonds before tax on interest will be applied, assuming no other savings accounts are held.

Bowes explained: “If you deposited £75,000 into a three-year bond paying 1.30% which pays interest annually – but you opted to roll that money over each year, as the interest is still deemed to have been received annually (even though you don’t physically get in until the maturity) you would receive gross interest of £975 in year one, £987.68 in year two and £1,000.51 in the final year – just breaching the Personal Savings Allowance in that last year. The previous years and subsequent interest amounts earned are under the PSA so there would be no tax liability.

“However, with the Green Savings Bonds, as the interest is counted only in the year of maturity, you can only deposit £25,310 without breaching the PSA as you’ll receive the total interest in one fell swoop – in this case £999.98.”

She added: “Some savers will be eligible for the starting rate for savings, which means you can earn an extra £5,000 in interest before it is liable for tax. However this only applies to those whose other income (so wages or pension income for example) does not exceed £17,570.”