PUTTING away £25 a month into a Junior Isa could give your child almost £11,000 by their 18th birthday.

A Junior ISA is a tax-free savings account for under 18s where you can save up £9,000 a year.

There are almost one million Junior Isa accounts open in the UK – but this means MILLIONS of kids are still missing out.

The annual allowance was more than doubled last year to £9,000. That’s the amount you can save tax-free each year.

As the tax year ends on April 5, you have just five days to open an account and make the most of this year’s allowance.

But we want to show you how easy it is to build up a decent pot of cash for your kid by only saving £25 a month.

A leg up for your child’s future

MUM-OF-ONE Ozlem Giray set up a JISA account for her 11-year-old son, Arda, after switching from a Child Trust Fund.

The maths teacher, 51, who lives in Walthamstow tries to pay £100 a month into her son’s JISA.

Her plan is that the account will hit £12,000 by the time Arda is 18.

She uses a savings app called Beanstalk – and it warns that Brits are overpaying £200million in unnecessary fees to CTFs, which are closed to new savers.

Arda’s account is split 60% stocks and shares and 40% cash, as Ozlem wanted to balance the risk of investing.

She says: “When I say it’s for his future, it’s not huge, but at least it might help with whatever he wants to do, when he starts university or if he wants to travel the world, or buy a nice car.”

She also said it’s a great way of saving sensibly during the pandemic because grandparents can top up the account too which is helpful, “especially as in lockdown they can’t come over with a present so they share money online instead.”

When you open a JISA, the first decision you need to make is between a cash JISA or a stocks and shares JISA.

Over 70% of Junior ISAs opened are cash savings products.

The cash option is safer, so it’s usually the one people are drawn to first.

Your money is protected up to £85,000 and you know the interest rate is guaranteed.

Junior cash ISA – What are the best rates?

Banks and building societies offer cash accounts that pay an interest rate that can be fixed or variable.

You want to look out for accounts offering 2% plus as these are the best.

At the moment, Darlington Building Society and Bath Building Society both pay the top rate of 2.5% and you can open an account in either by post or in branch. You can open an account with £1.

The Family building Society has a rate of up to 2.4% but but only if you open it with £3,000. If you open it with £1,000 it pays 2.15% and with £1 – £999 you get 1.65%

Coventry Building Society allows you to transfer your savings from a Child Trust Fund but pays a lower rate of 2.25%. This account you can open by post or over the phone with only £1.

Tesco Bank pays a variable 2.25% too and its phone and online account can be opened from as little as £1 as well.

Halifax has a rate of 2% and you can open this account online or in branch.

While stocks and shares JISA can provide a bigger return, you are gambling with your cash.

Investment is always a risk as your money can go up as well as down.

You should never invest money you can’t afford to lose.

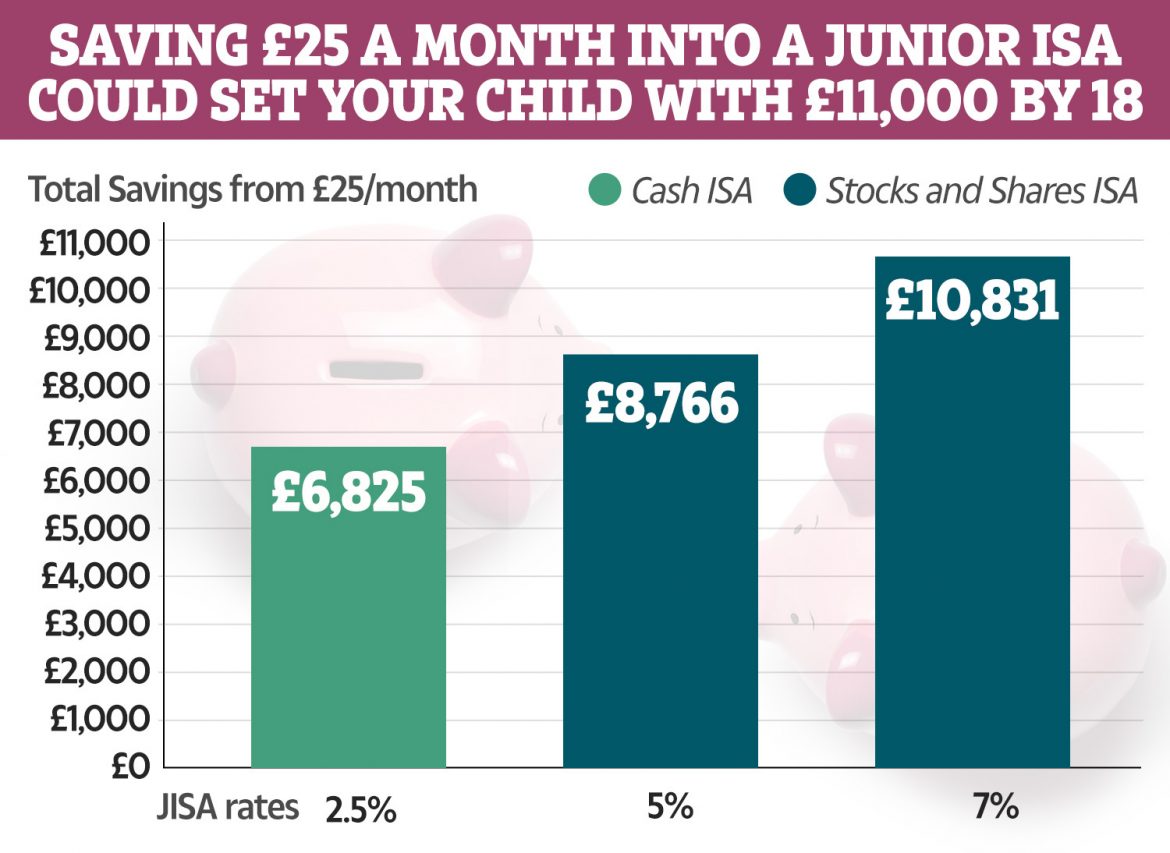

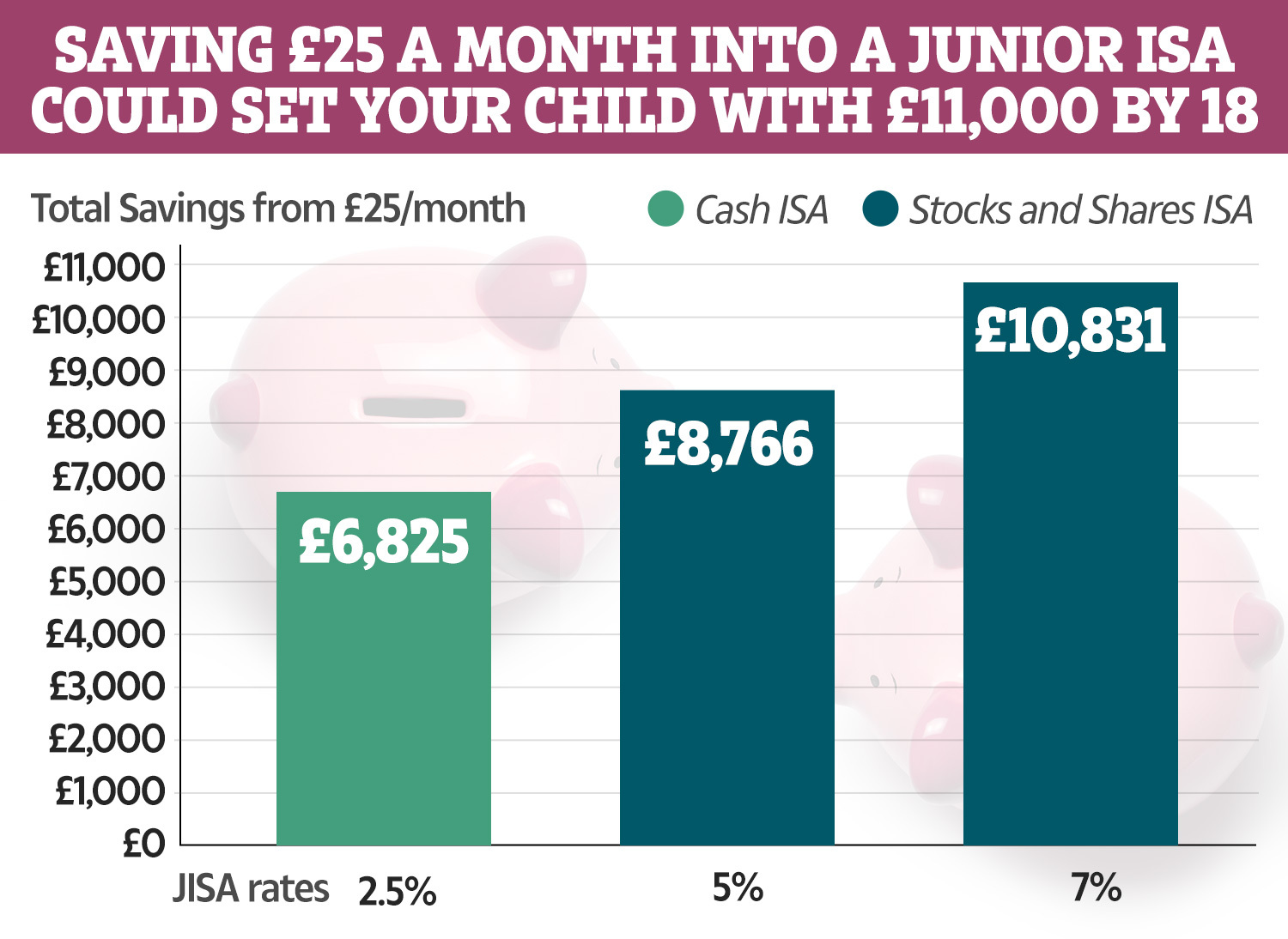

How £25 a month turns into almost £11,000

Calculations by Hardgreaves Landsown for The Sun show if you were to invest £25 a month in the top paying cash JISA at the moment, you might earn 2.5% for 18 years and could end up with a nest egg of £6,825.

With a stocks and shares ISA the rates and interest earning an average of 5%, the same monthly contribution could grow to £8,766.

And if it grew at an average of 7% you could then end up with £10,831.

If you could bump your monthly payments up to £35, under the same assumptions, cash could build to £9,555, investments growing at 5% to £12,273 and investments growing at 7% to £15,163.

You can’t withdraw cash from a JISA until your child turns 18.

We’ve told you before how you can give your child £18,000 on their 18th birthday by saving just £1.67 a day.

There’s even the chance to make your child a millionaire by the time they are 65.

Money saving expert, Martin Lewis, has explained how you need to put £1 in a LISA if you hope to buy your first home in the next 10 years.