The dramatic cut takes place on 8 December. Here’s what you need to know and options for the best new home for your savings (lots more help in our Top Savings guide.)

Savers with the Chip+1 account are hit by the cut and they total thousands

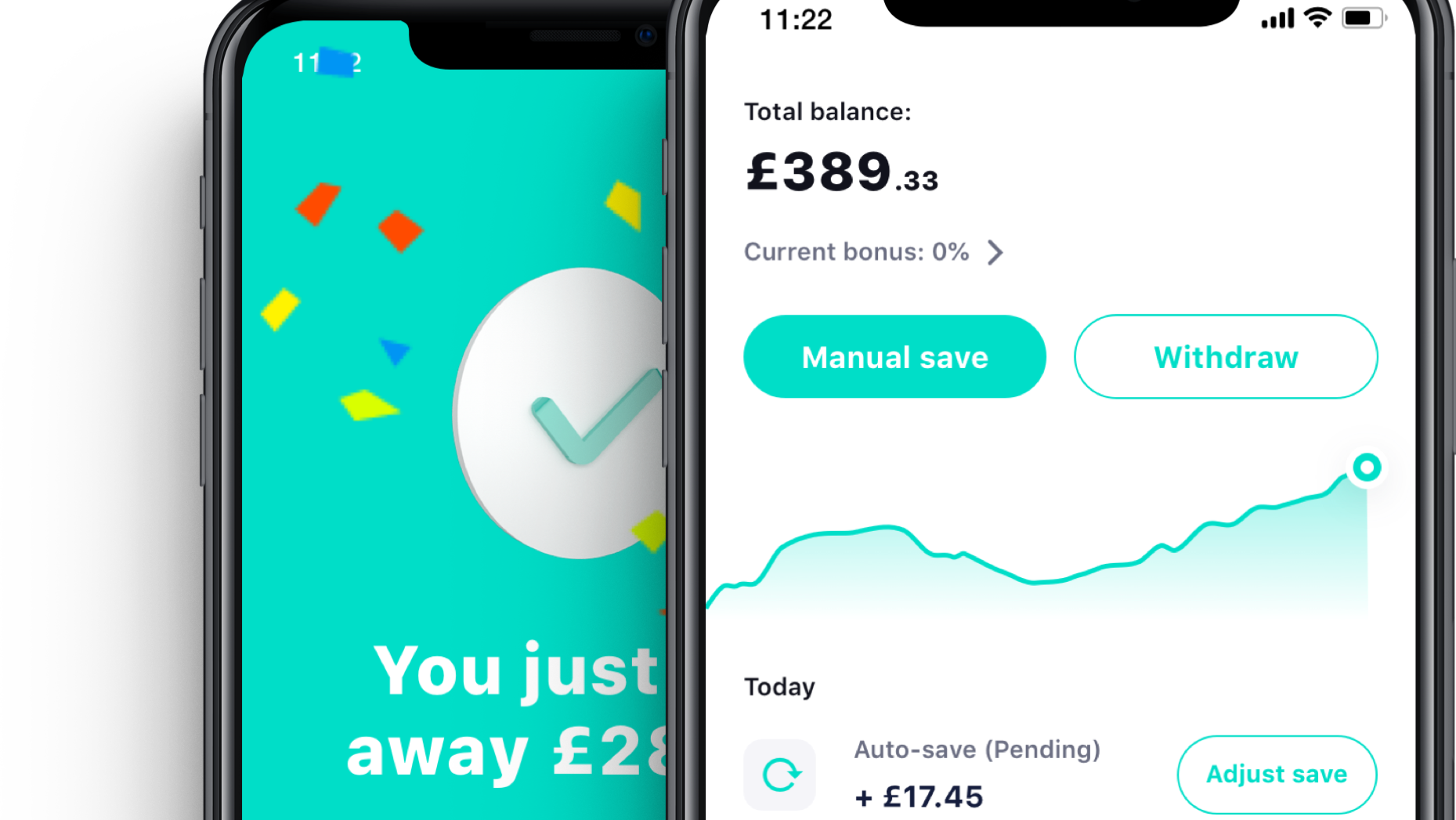

Chip is a savings app you connect your current account to through open banking. It’s known for autosaving, where it uses an algorithm to work out how much you can afford to save.

It has a number of accounts you can place money into, some of which (like many autosaving apps) pay nothing but the Chip+1 account pays 1.25% variable until 8 December after which it will pay 0%. Technically, this 1.25% is a bonus rate introduced in November last year and so it was always going to be pulled at some stage. Sadly, that time is now.

That said, some Chip customers not hit by the cut are already getting no interest so this is a good trigger to check if you’re prepared to put up with that – see our Top Savings guide for how to earn up to 2.05% on your cash.

If you pay a fee to Chip to access its accounts, you still will, even if the rate is 0%

To access its accounts, Chip has three membership plans. These aren’t changing which means some could be paying a fee for an account paying 0%. Here’s how it currently works for the Chip+1 account:

- ChipLite: its free plan but it only pays interest on up to £2,000, with no auto-saving functionality.

- ChipAI: it costs £1.50 every 28 days and lets you earn interest on up to £10,000, and includes auto-saving.

- ChipX: costs £3 every 28 days and lets you earn interest on up to £10,000, includes auto-saving and gives access to a stocks and shares ISA.

When the Chip+1 account was first rolled out, you could only access the account through invitation from someone who already uses the app or a referral code. And you could only unlock the 1.25% bonus by referring a friend if you were an existing customer or, if you were a newbie, you could get access by being referred. Chip closed access to the bonus rate to new users in August 2021.

Have cash in Chip+1? How to beat the rate cut

If you’ve savings in Chip+1, you need to take action before 8 December when the rate drops. Here are the best alternatives, depending on how much you have, and the current fee you pay. All accounts here have the full UK £85,000 savings safety protection.

- On the fee-free ChipLite plan? Get up to 2% fixed for a year elsewhere. Here, you don’t get access to the autosaving features anyway, so it’s all about chasing the best easy-access rate:

– You could ditch Chip and get 2% up to £1,500 with a current account. The Nationwide FlexDirect current account pays newbies 2% AER interest fixed for a year on up to £1,500, provided you can pay in £1,000+/mth. Plus, a cash bonus up to £125 if you switch your existing current account to it. Alternatively, or in combination, the Virgin Money current account* pays 2.02% AER variable interest on up to £1,000. Our Best Bank Accounts guide has full info.

– You could stay with Chip and get 0.7% up to £2,000. You can ask Chip to transfer your money over to its 0.7% easy-access account on 8 December, which is powered by Allica Bank. You’ll receive the 1.25% bonus on your Chip+1 account until it’s moved and can withdraw money at anytime, but you won’t be able to add additional deposits or autosave after 2 December.

– You could ditch Chip and get 0.67% up to £85,000 with the top savings account. If you don’t want the faff of opening a current account or are likely to save more than £2,000, then Shawbrook Bank is the top payer at 0.67% AER (min £1,000). If you’ve less, Cynergy Bank at 0.66% AER and Marcus* and Saga* at 0.6% AER all let you save from £1. See Top Easy Access Savings for full help.

- Paying for ChipAI or ChipX? Get up to 1.61% with the top shorter fixes. Here, if you do nothing, you’ll lose the rate and still be paying a fee for access to its autosaving features.

– If you want to continue using Chip’s autosaving features, get 0.7% up to £85,000. Ask Chip to transfer your cash and you can save up to £85,000 in its 0.7% easy-access Allica account (it’s max £30,000 if you transfer yourself). This also beats the top easy-access account if you’re saving £65,200+ after the ChipAI fee. You’ll receive the 1.25% bonus on your Chip+1 account until it’s moved and can withdraw money at anytime, but you won’t be able to add additional deposits or autosave after 2 December.

– Don’t use Chip’s autosaving features? Ditch Chip and get 0.67% (easy-access) or get up to 2.05% (fixed). If you don’t use Chip to autosave, the fee will unnecessarily eat into your interest, so a standard savings account elsewhere would win. Shawbrook Bank is the top easy-access at 0.67% AER (min £1,000) or, if you’ve less, Cynergy Bank at 0.66% AER and Marcus* and Saga* at 0.6% AER all let you save from £1. See Top Easy Access Savings for full help.

If you can afford to lock all or some of your cash away, fixed rates give a decent interest premium over those above. Zopa’s 1.35% AER one-year fix and Zopa’s 1.61% AER two year-fix (both min £1,000) are the current top payers. See top fixed-rate savings for full help and longer options up to 2.05%.

If you wanted to start autosaving, there are fee-free autosaving apps you can combine with the accounts above. See Automatic Savings for more.